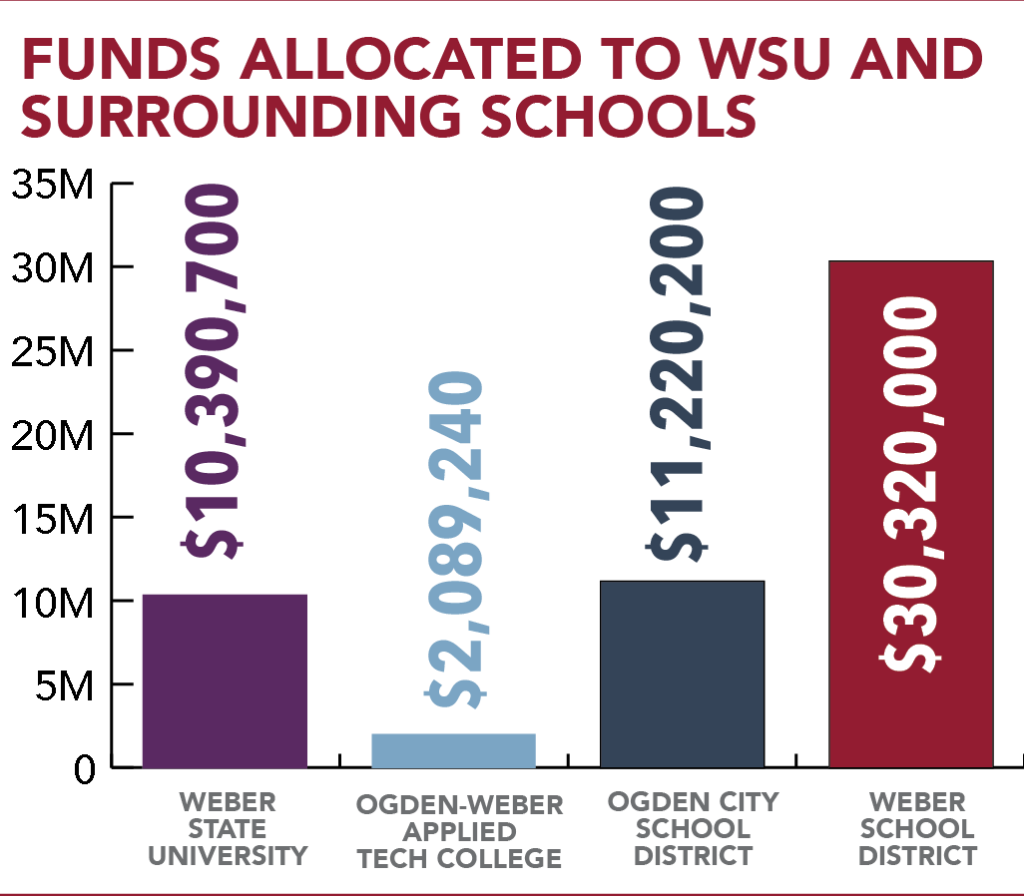

Weber State University students stand to benefit to the tune of $10,390,700 through Our Schools Now, a proposed initiative to increase education funding throughout the state through increased taxes.

OSN Campaign Manager Austin Cox asked Student Body President Aulola Moli and fellow WSUSA student leaders to aid in the collection of signatures needed to make the ballot — that is, of course, if after making themselves aware of the fundamentals, they are in support.

“What kind of Utah do we want?” Cox asked. Educating Utahns in job-specific fields being satisfied by out-of-state transplants, shortening the length of time it takes to graduate in Utah versus the rest of the United States and keeping tuition rates down are a few of the concerns among supporters of OSN.

Utah continues to hold the national title for the least amount of money spent per student, as it has for over three decades. On a national average, approximately $11,392 is spent per student each year, where in Utah available funds only allow for $6,575 per student each year for K–12 education.

According to the Utah System of Higher Education, WSU paid out $10,185 per full-time equivalent for the 2015–16 school year.

Weber receives $80 million in funding from the legislature annually. Last year, Weber was approved for an additional $30 million to renovate the social sciences building.

Institutions of higher education have more freedom to use appropriated funds than those of K–12. From the 1930s to 1996, taxes were completely devoted to K–12. The state legislature amended the constitution in 1997 to give said monies to higher education. The decision to do so created a deficit of $24 billion over the last 20 years in K–12.

Even though the legislature has granted an estimated $110 million to K–12 each year over the last five years, for Cox it is just a drop in the bucket to what is needed.

Proponents will introduce the Teacher and Student Success Act to the state legislature once they have obtained the 113,143 signatures needed to bring to the floor in order to qualify for the 2018 election.

As part of the Our Schools Now initiative, the Student and Teacher Success Act will restore decreased K–12 funding. Should registered voters approve this initiative, the Student and Teacher Success Act will take effect Jan. 1, 2019, increasing sales tax and income

tax rates.

Sales tax accounts for the largest percentage of educational funding. The current state sales tax rate is 4.7 percent. With both sales tax and income tax proposed to increase at 0.5 percent over a three-year span, funding for education will increase by $7 million.

As of July 2016, The United States Census Bureau reports there are 30.2 percent of persons under age 18 in Utah compared to 22.8 percent nationwide. What does this mean? The majority of Utah’s population is younger than 18 years of age and, therefore, lessens the pool of tax-paying citizens in where funding for education is drawn from.

Every school year, parents must pay registration fees for each child to seek a high school education. The Utah State Constitution, Article 10, Section 2 defines what constitutes the school system: Public elementary and secondary schools shall be free, except the Legislature may authorize the imposition of fees in the secondary schools.

This fact is an unexpected reality for families moving in from a state where there are no such fees. Registration fees for secondary schools throughout the state vary in need, thereby affecting the overall cost. Fees for Ben Lomond High School range from $85 to $155 for required textbook rentals, student activities and computer labs, with added optional fees for a yearbook and parking permit.

“Schools charge registration fees because they can,” spokesman for Utah State Board of Education Mark Peterson said.

Ben Lomond High school has relatively low-cost fees because of its standing as a Title-1 school.

Title I, Part A of the Elementary and Secondary Education Act, provides federal financial assistance to local educational agencies (LEA) and schools with high numbers or high percentages of children from low-income families to help ensure that all children meet challenging state academic standards.

Although federal funding through Title I helps some schools keep their registration fees down, the necessary amount approved by the school board does not come close to covering the cost of materials needed.

All money received by federal funding is dedicated to special populations, such as students with disabilities and students from economically disadvantaged backgrounds. School districts may appropriate property taxes where they feel they will be of best use.

“Keep in mind property taxes are higher in places like Park City,” Peterson said.

Not only are students suffering in the absence of materials, but educators are without necessary resources to teach effectively or access to funds needed to acquire teaching materials, thereby resulting in educators seeking employment outside the state.

“Required registration fees are merely another financial source to help pay for textbooks, student activities and computer labs,” Vice Principal of Ben Lomond High Jean

Thornell said.

To make certain no student is turned away by an inability to pay registration fees, the Utah Administrative Code states that all LEAs shall provide fee waivers. Of students enrolled at Ben Lomond High, 70–75 percent are attending school on a fee waiver.

This fact came as no surprise to Weber alum Russ Stevens. In his second year teaching at Ben Lomond High school, he has yet to experience the financial burden of the state board of education.

Ogden-Weber Applied Technology College is Stevens’ employer. They are the sole provider of all workshop equipment and materials, and, with the exception of the facility in which his class is held, neither OWATC or Stevens holds any ties with the state board of

education.

Technical colleges, higher education and public education will receive an additional $1,000 per pupil with the Teacher and Student Success Act, although there are ideas among those in the education system on how the hypothetical money should be used.

Neither the state board of education nor WSU has taken a position on the OSN initiative. For Stevens, on the other hand, “I am for anything that will benefit in the success of students.”

For proponents, collecting the required signatures is looking promising to some. Still, others are hoping they will not meet the deadline. The legislature is attempting to do the very same as proposed by OSN but without raising taxes.

Utah’s economy continues to rise and, with it, the pool of tax-paying citizens widens. Americans for Prosperity Utah believes raising tax rates will have adverse effects to what is being promised in the initiative.

Fee waiver requirements for secondary schools can be found under Section 53A-12-103(5) of the Utah Administrative Code.